This week, the patent consultant received communication from Dr. Sidirley Fabiani, one of the leading national experts in tax laws concerning innovation incentives.

This week, the patent consultant received communication from Dr. Sidirley Fabiani, one of the leading national experts in tax laws concerning innovation incentives.

Sidirley is a founding partner of Gestiona and a researcher at FEA-USP, specializing in innovation and entrepreneurship. He holds a degree in Engineering from POLI-USP and a degree in business administration from USP, as well as a master’s degree in Entrepreneurship and Innovation from FEA-USP and a postgraduate degree from ITA. For over 13 years, he has been engaged in innovation management, tax incentives, and raising funds for innovation.

What are the main laws to encourage innovation in Brazil? Can you give a brief summary of each of them? [the consultant]

Law of Good Law No. 11.196, enacted on November 21, 2005, highlights the following: * deduct R&D expenses, including those with research institutions, universities, or independent inventors, when calculating Income Tax; * exclude the value corresponding to up to 60% of the sum of expenditure made on R&D when determining the real profit for calculating IRPJ and CSLL calculation basis. This percentage may reach 70% with a potential increase of up to 5% in the number of employees exclusively hired for R&D activities and 80% with a larger increase than 5%. In addition, eligible companies can receive a 20% deduction on their total R&D spending that is subject to a granted patent or registered cultivar, as well as a 50% reduction in IPI when purchasing R&D equipment (whether national or imported). Furthermore, companies can benefit from immediate equipment depreciation and accelerated amortization of expenses for acquiring intangible assets related to R&D. * Zero reduction of the income tax rate withheld at the source for remittances made abroad concerning brand, patent, and cultivar registration and maintenance. * Deduction of amounts transferred to micro and small businesses, intended for R&D execution, interest, and on behalf of the legal entity that promoted the transfer, as operational expenses in the calculation of IRPJ and Social Contribution on Net Profit – CSLL. [Sidirley]

Information Technology Law (not exactly an incentive for innovation, but rather an incentive for industry)

The Information Technology Law (Law No. 8,248/1991) is an industrial policy instrument established in the early 1990s to enhance the competitiveness and technical training of Brazilian companies involved in the production of information technology, automation, and telecommunications goods. The Committee for Research and Development Activities in the Amazon – CAPDA (Committee for Research and Development Activities in the Amazon), supervised by the Secretariat of Innovation and New Business, oversees its implementation in the Manaus Free Zone (ZFM).

The Law’s incentives have boosted and are still promoting the establishment of factories, recruitment of personnel, upsurge in the production of IT commodities earmarked for the Brazilian market, alongside other beneficial effects on the region. The tax incentives granted are:

- IPI reduction of 80% until 2024, 75% in 2025 and 2026 and 70% from 2027 to 2029, for products with PPB; or

- IPI reduction of 100% until 2024, 95% in 2025 and 2026 and 90% from 2027 to 2029, for products with PPB and developed in the country (National Technology);

- Reduction of ICMS on the departure of the incentivized product in some states;

- Suspension of IPI on imports and purchases of inputs in the country and;

- Suspension of ICMS on imports and purchases of inputs in some states.

- Preference in the acquisition of IT, automation and telecommunications products developed in the country and with PPB, by bodies and entities of the federal public administration, direct or indirect.

Route 2030 (formerly Inovar-Auto)

New plan launched by the Ministry of Industry, Foreign Trade, and Services on April 18, 2017, was developed in collaboration with the private sector to establish a longer-term incentive plan for the automotive industry, surpassing the traditional four-year plan.

Since Inovar-Auto failed to accomplish all required objectives for the sector’s development during its execution, the goal of the new program, valid from 2018 to 2030, is to provide crucial incentives for automobile production and have a positive impact on the Brazilian economy.

Objectives of the new policy

Unlike the current Brazilian plan, Route 2030 must confer benefits to sustainable products exhibiting higher energy efficiency. Check out its main objectives:

- encourage technological innovations in the automotive sector;

- promote a new vehicle production cycle based on competitiveness, high productivity and innovative urban mobility concepts;

- organize actions that meet environmental preservation requirements;

- reduce the emission of polluting gases;

- ensure the safety of drivers and passengers;

- grant tax credits to companies that produce vehicles in Brazil and also to Brazilian importing companies.

With this, the idea is to reach the year 2030 with cutting-edge technologies, equivalent to those in global markets, and make Brazil emerge with differentiated projects and become a vehicle production hub. [Sidirley]

Is Good Law still there? Had it not been revoked at the end of the Dilma Government? [the consultant]

In fact, the Good Law was almost suspended, but fortunately the provisional measure (MP) 694/2015, published on September 30th and which announced the suspension of the tax benefit provided for in Chapter III of Law 11,196/2005 lost its validity, as in the On March 8, 2016, the deadline for converting MP 694/2015 into law ended, which fell due to the expiration of the deadline, and, consequently, the Lei do Bem came into force again.

It should be clarified that another provisional measure, MP 690, also published in 2015 and this time converted into Law 13,241/2015, directly affected other types of incentives provided for in the Lei do Bem. In its Chapter IV (On the Digital Inclusion Program), the law provided for the reduction to zero of the contribution rates for PIS/Pasep and Cofins, levied on the gross receipts from retail sales of telecommunications products. This measure, unlike MP 694, specifically affects the tablet, smartphone, mobile phone, router and modem industries, which have seen a significant increase in the cost of their products due to the reinstatement of full PIS/COFINS rates.

In this sense, there is often some confusion when it comes to Good Law and provisional measures. It is necessary to clarify that these are different points within the same law. In short, MP 694/2015 lapsed due to the expiration of the deadline and the incentives for research, development and innovation for Brazilian companies (Chapter III) remain in force, while MP 690/2015 has been converted into a Law and restores the full PIS/CONFINS rates for certain products (Chapter IV), which affects the incentive for their sale.

What are the requirements for participation in Good Law? [the consultant]

- Companies located in Brazil and that are in the Real Profit Tax Regime;

- Have Tax Profit in the Year (IRPJ and CSLL to be collected);

- Tax Regularity (Issuance of CND or CPD-EN);

- Invest in Research, Development and Innovation (RD&I) in Brazil.

What is real profit? What is presumed profit? [the consultant]

Real profit: Income tax and social contributions on profit are determined on the basis of the accounting profit calculated by the legal entity, plus the adjustments (positive and negative) required by tax legislation.

Also in this regime, PIS and COFINS are determined (with specific exceptions) through the non-cumulative regime, crediting the values of acquisitions made in accordance with legal parameters and limits.

Presumed Profit: simplifies the taxation of Corporate Income Tax (IRPJ) and Social Contribution on Profit (CSLL). It is important to note that, to be eligible for Presumed Profit from 2014 onwards, the total gross revenue limit is up to $78 million from the previous calendar year. Companies taxed by Presumed Profit cannot take advantage of PIS and COFINS credits as they are outside the non-cumulative system. However, they do collect these contributions at lower rates than those required by Real Profit.

What are the advantages for a big company that submits patent applications in Brazil and other countries using the Law of Good? [the consultant]

The primary incentive of the Good Law relating to intellectual property is limited to granted patents, not those that are merely deposited. It involves excluding 20% of total R&D expenditures subject to a granted patent or registered cultivar when calculating the IRPJ and CSLL bases.

In addition, the income tax rate withheld at the source for remittances made abroad for the registration and maintenance of trademarks, patents, and plant varieties is reduced to zero. [Sidirley]

In short, what is the procedure for using the incentives of the Good Law? [the consultant]

The declaratory system enables legal entities conducting technological research and development to use tax incentives. They can dispense with formal requests and MCTIC approvals for R&D projects. Instead, entities can determine compliance with legislation requirements themselves. Going forward, he automatically prepares his accounting with or without the benefits and must monitor R&D expenses in designated accounts. Companies receiving tax incentives are required to provide MCTIC with yearly information regarding their technological innovation research and development programs by July 31st of the subsequent fiscal year through the Electronic Form approved by Ordinance No. 327 of April 29th, 2010.

What are the additional requirements for utilizing the Good Law? [the consultant]

Legal entities that receive tax incentives must provide MCTIC with yearly information on their research and development programs for technological innovation by July 31 of the subsequent fiscal year. The submission must be made through the Electronic Form that is authorized by the April 29, 2010, Ordinance No. 327. Additionally, they must monitor R&D expenses in designated accounts, keep records related to incentives offered by the Federal Revenue Service, and provide proof of fiscal compliance (CND or CPD-EN) for the applicable time frame.

On average, how much of its income tax does a large company save by qualifying for the benefits of Good Law? [the consultant]

Considering the latest official data published, referencing the base year of 2014, the average estimate per company is approximately $1.7 million. [Sidirley]

How many and which (examples) companies currently use Good Law? [the consultant]

The preceding graph (2006 to 2014) illustrates that both the amount of companies taking part in the tax incentive program and the number of companies suggested by MCTIC (which fulfilled the criteria of the Good Law with or without limitations) have increased annually.

The leading companies in various industries including automotive, software, petrochemicals, electronics, food, consumer goods, pharmaceuticals, and metallurgy utilize the benefits of the Good Law incentives.

At this link, you can access all MCTIC Official Reports up to the base year 2014. These reports provide the list of all participating companies in their respective years. [Sidirley]

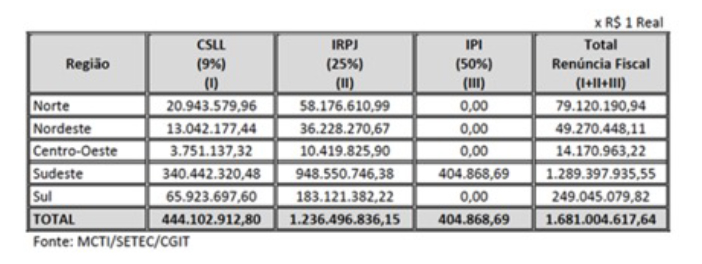

What is the total amount of yearly incentives awarded globally? [consultant]

Calculating the tax benefits of 991 recommended companies in the Base Year 2014, the table above demonstrates a net gain in total tax exemptions for companies of $1.68 billion. This amount represents a 6.33% increase from the fiscal year of the Base Year of 2013, which was $1.58 billion.

How does the incentive approval analysis procedure work? What is the approval percentage of participating companies? [the consultant]

The MCTIC receives technical assistance from Committees comprised of professionals with expertise in the economic activities of companies that benefit from the Good Law. These Committees provide opinion diagnoses that support the Ministry’s Opinions. project analysis. Subsequently, MCTIC issues a Final Opinion after the deadline for Reply Requests and publishes a Report listing all companies that submitted their Form within the legal timeframe.

It is solely the responsibility of the RFB to determine whether each recipient company is required to resign. The competency for this tax-related issue rests exclusively with the RFB, and they maintain possession of the database containing details of companies that completed the DIPJ form, including information on those who utilized these incentives. The RFB is responsible for verifying the accuracy of the information by monitoring it and cross-checking the data in the DIPJ and provided by the MCTI. As the legal authority in tax matters, it checks for errors or fraud, including potential undue tax waivers.

With the implementation of the Technical Opinion mechanism, MCTIC now only publishes a list of the companies participating in the Good Law program. While partial approval or disapproval of projects and expenditures is possible, we estimate that the approval rate for presented projects is between 75% and 85%.

Is there any alternative for small entrepreneurs to participate in Good Law or other incentive laws? [the consultant]

Unfortunately, there are still few options in Brazil.

The Good Law permits deducting amounts transferred to micro-enterprises and small businesses, meant for the execution of R&D, of interest and on behalf of the legal entity that initiated the transfer from the operational expenses when calculating IRPJ and Social Contribution on Net Profit – CSLL.

Several state and municipal programs are available to support small businesses. One notable example is the FAPESP Innovative Research in Small Businesses Program – PIPE (Pesquisa Inovativa em Pequenas Empresas), which has been in operation since 1997. This program supports the development of innovative research in small companies located in the state of São Paulo, focusing on significant issues in science and technology that have a high potential for commercial or social impact.

The PAPPE, an initiative of the Ministry of Science and Technology – MCT (Ministério da Ciência e Tecnologia), is executed by the Financier of Studies and Projects – FINEP (Financiadora de Estudos e Projetos) in partnership with state Research Support Foundations – FAPs (Fundações de Amparo à Pesquisa). The program aims to finance Research and Development (R&D) activities for innovative products and processes undertaken by researchers who collaborate with or work for technology-based companies.